can you go to jail for not paying taxes in india

The penalties are harsh. False claims in tax deductions and tax credits.

How Can I Study And Invest In The Indian Share Market Stock Market Investing In Stocks Intraday Trading

The short answer to the question of whether you can go to jail for not paying taxes is yes.

. Youll have plenty of time to settle your debt or at the very least contact the IRS to avoid arrest. Not all debts are created equal and when it comes to a failure to pay court-ordered child support or taxes it is possible to go to jail for not paying these debts. Can you go to Jail for not paying your taxes.

And you can get one year in prison for each year you dont file a return. However you will not go to jail for not paying your taxes. In other words a debt collector can not send someone to jail for.

The good news is that its unlikely to happen to you unless you are intentionally evading the IRS and you owe a lot of money. To avoid late payment penalties you can simply. Any action taken to evade the assessment of a tax such as filing a.

Contact us at 630 932-9600 or through our website for more information on tax services by Accounting Tax Advisers CPAs. Can you go to jail for not paying taxes in india. Most of the time you will be provided an opportunity to make it right by paying your taxes.

The IRS doesnt go after many people for tax evasion but when they do the penalties are harsh if they are convicted. Up to 25 cash back If you continue to refuse though you might be facing a jail term. Purposely failing to file the income tax return.

It means omitting or misrepresenting data sheets and even withholding crucial information that could unquestionably make a business or organization pay more taxes. Cases where the amount of tax sought to be evaded or tax on under-reported income is lesser than 25 lakh the person can be punished with imprisonment of at least three months and up to two years and with fine. It would take a lot for the IRS to put you in jail for fraud.

Absolutely yes you can go to jail for not paying your taxes. Furthermore the IRS cannot simply take your bank account your car or your house. When Accounting Tax Advisers CPAs handle your affairs the question Can you go to jail for not paying taxes becomes a moot point.

Whether a person would actually go to jail for not paying their taxes depends upon all the details of their individual tax circumstances. Yes You Can Go To Jail For Past. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen.

The IRS will not put you in jail for not being able to pay your taxes if you file your return. The IRS will charge you 05 every month you fail to pay up to 25. Sometimes people make errors on their tax returns or are negligent in filing but they are not intentionally.

The last date to file income tax is 31 July. It depends on the situation. Not only does the court order the person to pay the money owed plus penalties fees and interest they are also looking at a prison sentence of up to five years.

Any action you take to evade an assessment of tax can get one to five years in prison. False Declaration By Non Pan Holders Land In Jail 24 India News An English Online News Web Portal How To Apply Online Online Shopping Funny Pin On Real Estate News. The United States doesnt just throw people into jail because they cant afford to pay their taxes.

The following actions can land you in jail for one to five years. However you can face jail time if you commit tax evasion. Criminal charges can only be filed if you engage in tax evasion when you break the law to avoid paying taxes including hiding income falsifying documents or failing to file a tax return.

Short of these two however an indebted individual should not have to worry about the prospect of jail time. 7 hours agoWhether income is from salary or from your business everyone is liable to pay tax. Some things that could potentially put you in jail for 1 to 5 years include.

Is It Possible to Face Jail Time for Unpaid or Unfiled Taxes. You can go to jail for cheating on your taxes but not because you owe some money and cant pay. Other tax crimes arepunished as misdemeanors meaning that you could go to prison for up to a yearbe fined up to 100000 200000 if you run a corporation or both plus.

However your actions must be willful and intentional which means you will not be arrested on the spot. To put it as simply as possible you can be arrested for not paying your taxes not a jail term. Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall in addition to other penalties provided by law be guilty of a felony and upon conviction thereof shall be fined not more than 100000.

Can you go to jail for not paying taxes in india Monday June 13 2022 Edit. In a nutshell the bad news is that you can get arrested if you dont pay your taxes. May 4 2022 Tax Compliance.

Failure to non-filing of. However if you do not file and pay the failure to file the amount is subtracted from the failure to pay the amount. Your name will also be a part of the credit card defaulter list in india.

For each month the IRS places a 5 of the unpaid taxes penalty for returning your taxes late maxing at 25. Wilful income tax evasion may land you in jail for up to seven years. Do you need more information about what happens when you dont pay taxes.

Parole In India And Laws Related To It Ipleaders

You May Land Up In Jail For Non Filing Of Itr File Income Tax Business Reputation Filing

Corruption Case Former Haryana I T Deputy Commissioner Gets 4 Years In Prison India News The Indian Express

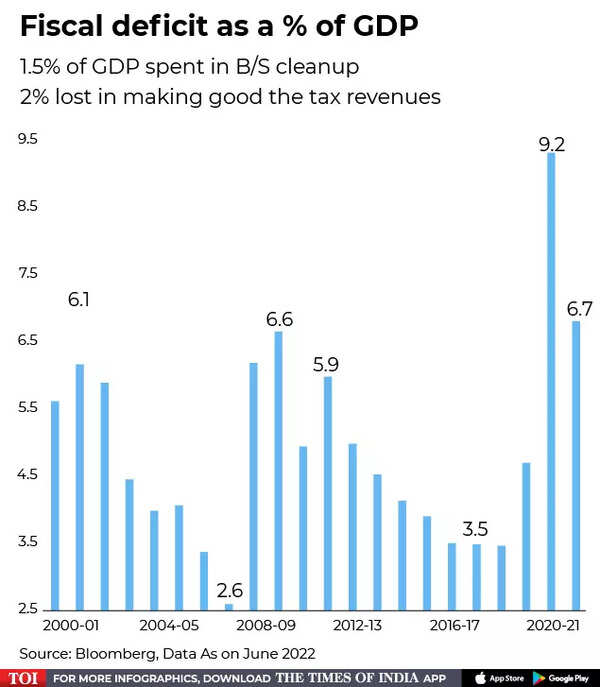

Is There A Stimulus By The Centre No One Is Talking About Times Of India

Can You Go To Jail For Not Paying Taxes In India Quora

Explained How Jails Pay And Deduct Prisoners Wages Explained News The Indian Express

5 Income Tax Penalties In India Abc Of Money

Can You Go To Jail For Not Paying Taxes In India Quora

Ease Of Doing Business Not When There Are Over 26000 Ways To Put An Entrepreneur In Jail

Non Filing Of Itr Returns Can Land You In Jail Know Penalties And Other Implications

Huawei India Ceo 3 Executives Summoned In I T Case In 2022 Taxact Income Tax Latest Business News

India S Route Is Crypto Regulation Through Taxation Bloomberg

Fact Doyouknow Knowyourrights Law Food Foodtem Notinagoodcondition Jail Taxolawgy Justiceforall Social Cause Freelancing Jobs Facts

Policy Watch How Serious Is India About Ease Of Doing Business

Only 1 Of India Pays Income Tax Govt Shows Proof Tax Evasion Still A Major Roadblock The Financial Express

Pin By Matt On Joe Rogan Quotes Life Captions Tax Quote Joe Rogan

India Withdraws Capital Gain Exemption Allowed To Singapore Residents Capital Gain Withdrawn Singapore

Itr Filing This Income Tax Return Violation May Land You In Jail Details Here Mint